How Dracula Hedge Funds Are Sucking Us Dry

The official June unemployment rate is 9.2 percent. The real rate is 18.5 percent (which includes involuntary part-time workers and the unemployed who haven’t looked for jobs in the past four weeks.) Nearly 30 million Americans are unemployed and we need more than 21 million jobs to get back to full-employment (defined as five percent).

Meanwhile, the top ten hedge fund elites make on average nearly $1 million an HOUR. We’ll never find the resources to solve the unemployment crisis until we redistribute some of this obscene wealth.

It starts by putting to rest the notion that hedge fund elites are just like any other. They are not. They make more money than everyone else, including our top movie stars and athletes...and they pay lower taxes.

While working on my next book on financial elites, we dredged up a variety of “Top Ten Income Lists” (from sources like Forbes and Equilar) for just about every kind of high-rolling celebrity and CEO imaginable. Here are previews:

- Oprah led the pack by hauling in an incredible $290 million in 2010.

- U2 at $190 million was the top pop musical group.

- Leonardo DiCaprio ($77 million) is the leading Hollywood star.

- Tiger Woods ($75 million) remains the highest paid athlete even though he doesn’t play much golf these days.

- Half of the highest paid non-financial CEOs are in the entertainment business, led by Phillipe Dauman of Viacom ($84.5 million).

- Only six out of the 100 highest income Americans on these lists are women.

You also might find it interesting that the top Wall Street bankers are keeping a low-income profile these days. Maybe it’s an attempt to avoid stricter regulatory curbs on their financial casinos. Jamie Dimon of J.P. Morgan Chase led the bank/insurance top ten list with an income of $20 million (which, by the way, is half as much as Glenn Beck’s 2010 income). Lloyd “Doing God’s Work” Blankfein of Goldman Sachs was 10th on the banker list with an income of $14.1 million.

All in all, we’re talking about serious money—except for the fact that hedge funds make 100 times more than bankers.

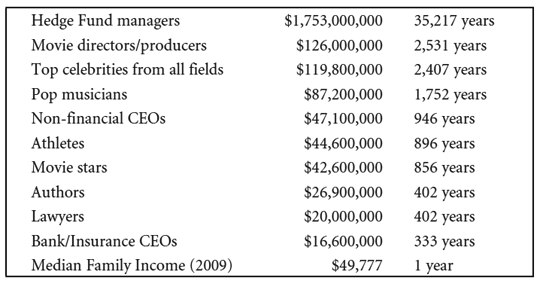

Here’s the summary table for the “Top Ten” lists for 2010—to put the numbers in perspective, median family income is included.

The Highest Income Celebrities, CEO and Hedge Fund Managers of 2010

The following figures represent the Top Ten Average Yearly Income from Hedge Fund managers at the top of the earnings list, to the median family income at the bottom; and how many years it would take for the average American family to earn as much.

For me, the right-hand column says it all. What notion of economics, fairness or ethics justifies the fact that it would take the average family more than 35,000 years to earn as much as the average hedge fund elite earns in one year? And hedge fund honchos can’t sing, dance, write, direct, or play baseball. Yet, whatever they do dwarfs what such stars make. They also don’t make iPads or social media or cars. Yet they make many times more than CEOs of non-financial corporations. What could those hedge fund moguls possibly do to earn such riches?

In economics, there’s supposed to be a connection between what you earn and the economic value you produce. Otherwise, it’s called an economic “rent”—which is just a polite way of saying it’s an outright rip-off. These guys (and they are all guys) are ripping off our economy, and it’s up to us to put a stop to it.

Why am I so sure they’re ripping us off? I’ve had the dubious honor of exploring some of their biggest deals, including the “Greatest Trade Ever,” in which hedge funds bet against the housing bubble and won big. It turns out those bets were rigged. Hedge funds brazenly colluded with big investment banks to create securities that were designed to fail, so they could bet against them. So far the SEC has forced Goldman Sachs to pay $500 million in penalties and JP Morgan recently coughed up $153.6 million. This was to settle charges that these banks failed to inform investors that hedge funds had a heavy hand in constructing securities so that they would fail.

In fact, we can now show that hedge funds helped to prolong the housing bubble, deepen the crash and profit along the way. No matter what their apologists say, those hedge fund profits came from trash securities that never should have seen the light of day. Not only didn’t they create positive value for the economy, they created billions of losses that led to bailouts, unemployment and massive public debt. Whether any of them engaged in outright fraud, we leave to the courts. It doesn’t matter. It was a monumental economic rip-off, whether legal or illegal.

To add enormous insult to our grievous injuries, these hedge funds managers only pay a 15 percent federal income tax rate (instead of 35 percent) on nearly all of their obscene incomes. That’s because of a tax loophole that allows them to declare their income as capital gains—they call it “carried interest.” The Obama administration and many in Congress claim they will do away with this loophole. Hedge fund groupies say it won’t matter anyway because these financial sharpies will just restructure their hedge funds in ways that will allow them to avoid paying taxes like the rest of us.

Why on earth should hedge funds pay lower rates than the rest of America? They certainly can’t demonstrate that they add value to our economy. The only claim they honestly can make is the one that has surfaced many times throughout human history: We are powerful. We set the rules. We deserve what we get...and more...and more. And politicians with their hands out will always find ways to help.

Why are we putting up with this?

A groundbreaking study by Michael Norton of the Harvard Business School and Dan Ariely of Duke University provides some important insights. Using a nationwide survey of more than 5,000 respondents, they discovered that most Americans have no idea how skewed our income distribution really is. Virtually everyone surveyed believes our wealth distribution is much fairer than it actually is. And when people were asked to come up with their ideal wealth distribution, 92 percent chose the wealth distribution of Sweden! (PDF)

More amazing still was that it doesn’t matter whether you are Republican or Democrat, rich or poor, black or white, male or female. Everyone wants more economic fairness.

And yet, we get more and more inequality, led by hedge fund elites.

As the study strongly suggests, the key to unlocking our pent-up desire for fairness is to develop a widely shared understanding of just how skewed our income distribution really is. And that starts with shining a blazing bright light on hedge funds elites, who will enjoy the sunshine about as much as Dracula does.

Les Leopold is the executive director of the Labor Institute and Public Health Institute in New York, and author of The Looting of America: How Wall Street’s Game of Fantasy Finance Destroyed Our Jobs, Pensions, and Prosperity—and What We Can Do About It (Chelsea Green, 2009).

—AlterNet, July 9, 2011

http://www.alternet.org/story/151569/how_dracula_hedge_funds_are_sucking_us_dry